Understanding Medicaid’s Long-Term Care Spousal Impoverishment Rules

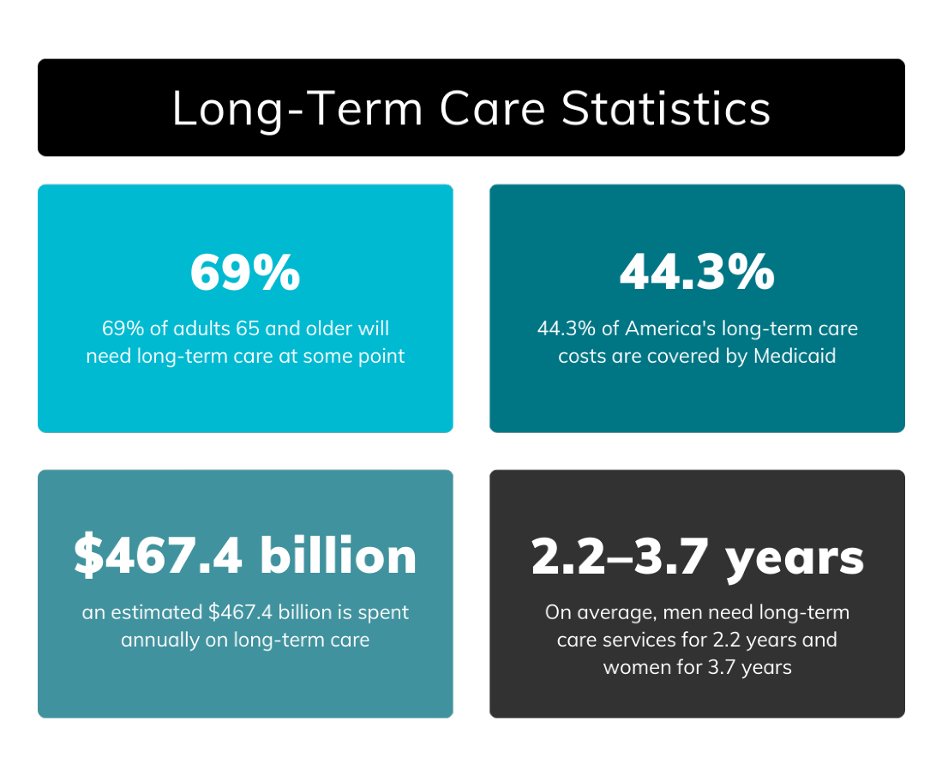

The prospect of long-term care often brings with it many financial concerns. As we experience our declining health or that of an aging family member, we begin to realize that long-term care needs at home or in a facility could be necessary. When looking into local senior home care services and skilled nursing facilities, the astronomical cost of care becomes apparent. If you or your loved one has not set aside financial resources, or purchased long-term care insurance, the next step may be spending down everything you own to qualify under Medicaid’s spousal impoverishment rules.

Medicaid Long-Term Care Benefits & Spousal Impoverishment Rules

Medicaid is a joint federal and state program that provides crucial support for individuals who have low incomes or disabilities, including seniors who require long-term care services but can’t afford them. The program serves as a vital safety net for the long-term care needs of aging adults, covering various services, depending on your state. For example, you may be able to receive assistance paying for a nursing home facility, some assisted living costs or Medicaid home care services.

However, the eligibility requirements for Medicaid long-term care benefits are complex, and the application is confusing. If you don’t fully understand how to qualify, you can make mistakes that delay the funds you desperately need to pay for care.

Does a Spouse’s Income Affect Medicaid Eligibility?

Medicaid considers a couple’s assets and income in determining eligibility. That’s why many aging adults worry they will lose their homes before qualifying for coverage to pay medical expenses. They’re also troubled about what will happen to a spouse who is still healthy. If one qualifies for care based on joint income, money, and property, how will it affect the other’s living arrangements and expenses?

Can a Nursing Home Take Your Spouse’s Pension?

Aside from your home, a pension or other retirement account may be your most significant financial resource. The idea that it might be taken to pay for medical expenses is scary. If you or your spouse qualify for Medicaid, you will be required to pay a portion of your cost from your own income.

A pension is considered a countable income resource when applying for Medicaid. If your income or asset level doesn’t allow you to qualify for Medicaid, you will have to pay the cost out of your own pocket.

401(k)s and IRAs

When companies began offering 401 (k) plans instead of pensions, employees often rolled them over into IRAs on retirement. Under state Medicaid program laws, retirement accounts can count toward your asset limit or your income limit.

There are times when retirement accounts can be exempt, depending on what state you live in, whether you are receiving payments, and which spouse owns the account. But most states view retirement accounts as countable, regardless of payout status or ownership. Even if your retirement account takes you over Medicaid’s asset or income limit, you can still become eligible, but the legal strategies are complicated.

- You can cash out your retirement account and spend down the proceeds until you’re below the asset limit, but there are strict rules on what you can spend the money on, described under the community spouse resource allowance (CSRA) provision. You also may experience significant tax consequences.

- Discuss the need for government benefits and their effect on your pension or retirement account with an elder law attorney and financial advisor before long-term care services become necessary. It’s the best way to find a solution that works for you.

Can One Spouse Be on Medicaid and the Other Not?

If one spouse requires long-term care while the other remains at home, the healthy spouse risks financial hardship if the cost of care exceeds their combined available resources. To prevent this, the healthy spouse (community spouse) may use Medicaid’s spousal impoverishment rules to retain income and assets.

These particular rules are designed to prevent a healthy spouse from falling below the poverty threshold while maintaining a reasonable standard of living The healthy spouse retains a certain level of income and assets without jeopardizing the institutionalized spouse’s benefits for necessary care.

Certain assets, like a primary residence, personal belongings, and a vehicle, may be exempt from consideration in determining the institutionalized spouse’s eligibility for Medicaid long-term care. The exact amounts and thresholds can vary by state and are subject to changing Medicaid regulations.

Spousal Impoverishment Rules & Community Spouse Resource Allowance (CSRA)

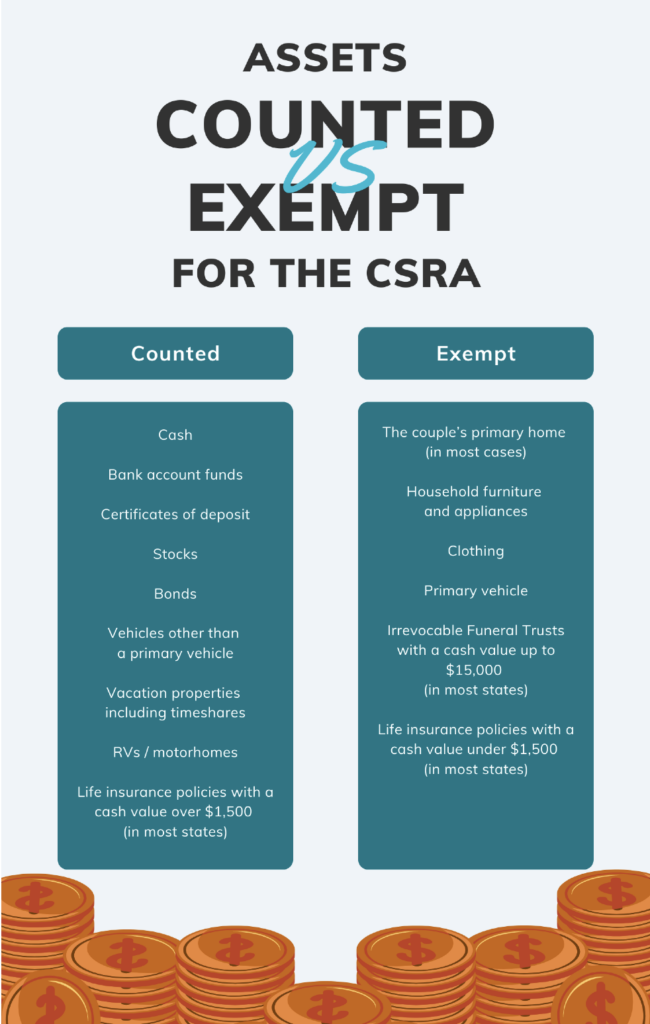

A married couple’s financial resources, called assets, have different rules than those that apply to income. All assets are considered jointly owned and count toward the Medicaid applicant’s asset limit, even if only one spouse applies for long-term care Medicaid. The community spouse resource allowance (CSRA) preserves a portion of combined assets for the person who remains at home.

Meanwhile, other assets are exempt and not counted toward the asset limit. Exempt assets generally include:

- A primary home

- Household furnishings and appliances

- Personal items, like clothing and wedding rings

- A vehicle

While a Medicaid applicant is generally limited to $2,000 in assets, the CSRA allows the community spouse to retain a much higher amount. The federal government sets a minimum and a maximum resource allowance, which increases annually. In 2024, the spouse at home was permitted to have up to $154,140 in assets.

It is important to note that each state has its own formula for determining the amount of assets that a community spouse can retain.

If your combined assets are greater than the allowable amount, you may have to spend down your assets to meet the Medicaid limits for you and your spouse. Spending down doesn’t necessarily mean liquidating financial accounts and property. It can be done in several ways, including:

- Paying for home modifications to improve safety and accessibility

- Purchasing exempt assets

- Transferring assets to a child with disabilities

- Prepaying Medicaid compliant funeral/burial costs

- Purchasing a Medicaid compliant annuity that converts assets into a monthly income stream

Legal strategies can help married couples retain more of their income and assets, but they are complicated and, if not done correctly, can violate Medicaid’s transfer rules, resulting in Medicaid penalties. The lookback period is five years in all states but California. Medicaid will check for money and property transfers five years before your application. The value of these items will determine the length of time Medicaid will deny coverage.

Until that time passes, you will have to pay long-term care expenses out of pocket. The estimated national average for nursing home care in 2025 is between $8,000 and $10,000 per month. Your life savings can diminish very quickly.

To get an idea of what this looks like, you can calculate your total countable assets and spend down amounts online. Take this information to an elder law attorney as a starting point for developing a long-term care plan. An online estimate may fail to consider ways in which you can effectively redistribute your income and assets or meet spousal impoverishment rules.

The Minimum Monthly Maintenance Needs Allowance (MMMNA)

Medicaid is a cost-sharing program. As such, Medicaid recipients will be required to spend nearly all of their income, minus a few small deductions, as part of their share of cost to the facility. This can be stressful when a well spouse remains at home and does not need long-term care.

This is particularly true when there is a large disparity between the incomes of the spouses. The most common reasons for income disparity include:

- One spouse worked during the marriage, while the other spouse stayed home to raise the children.

- It’s a second marriage, and one spouse didn’t have continuous employment, resulting in a smaller retirement income.

The minimum monthly maintenance needs allowance (MMMNA) is designed to be a safeguard against the impoverishment of the community spouse. The MMMNA sets forth the least amount of income a healthy spouse may receive without affecting the institutionalized spouse’s benefits. The institutionalized spouse can transfer a portion, or sometimes all, of their monthly income to their healthy spouse if the community spouse’s income does not reach the minimum.

The federal government sets MMMNA figures annually based on the Federal Poverty Level (FLP). but states implement their own variations within the federal allowances.

If your spouse has income under their state MMMNA and you need Medicaid benefits for care, they can receive income from you to increase it to the minimum threshold. In some states, you may be able to increase it further based on certain shelter and utility costs.

An elder law attorney can look at your finances and let you know how the MMMNA provision affects your specific circumstances. There may be other options, and determining the right strategy is crucial for further preserving your property, savings, and quality of life.

Learn More about Medicaid Spousal Impoverishment Rules from Experienced Professionals

The minimum monthly maintenance needs allowance and community spouse resource allowance are two excellent provisions for protecting healthy spouses. However, there are other ways to protect your home and life savings as well. Guidance from financial advisors, in collaboration with elder law attorneys can significantly help aging adults and their families navigate the complexities of Medicaid’s spousal impoverishment rules to access necessary long-term care benefits.

The goal is to avoid financial stress and be in a position to choose your facility and level of care when the time comes. You will also feel relief knowing that your spouse will continue to live comfortably, regardless of what happens. Contact, Andre O. McDonald, a knowledgeable Howard County, Montgomery County and District of Columbia estate planning, special-needs planning and Medicaid planning attorney at (443) 741-1088; (301) 941-7809 or (202) 640-2133.

DISCLAIMER: THE INFORMATION POSTED ON THIS BLOG IS INTENDED FOR EDUCATIONAL PURPOSES ONLY AND IS NOT INTENDED TO CONVEY LEGAL, INSURANCE OR TAX ADVICE.